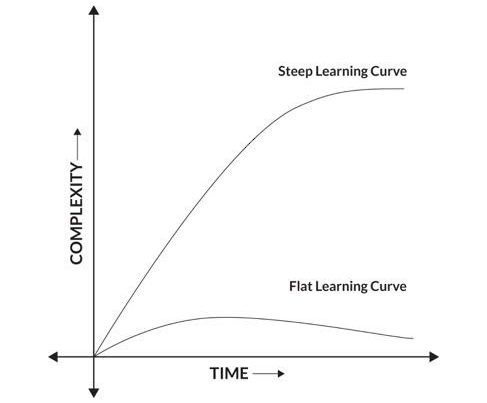

I am a part-time prof & consultant/trainer with corporates and hence am blessed with the opportunity of interacting with 21-25 – year old B-School students, the so-called Gen Z (born around 1995 to 2012). A lot has been written about them, they are the ones who have grown up with the internet….. well almost. So, their instincts have kind of been formed with a digital bias, i.e. what we had to learn (surfing the web for content) in our 20s & 30s, these kids were doing at their age of five and six, or even lesser. By virtue of being in academics over the last decade, I am in touch with a lot of my past students, in their late twenties and early thirties. These folks are kind of settling down/have settled down into their careers. They keep sharing their personal milestones and disappointments with refreshing candour. That gives me a peek into what excites &drivesthem in life and their careers. What I notice is that, this generation, despite having grown up in relative luxury (which their parents have been able to offer them), is not prone to impulsive buying. They will deliberate the purchase of small stuff, such as a trendy T-shirt. They will surf multiple e-commerce platforms to check out deals, will visit a few brick and mortar stores, click pictures of the merchandise on display, upload them on snapchat, Instagram and the like, seek approval from their online ‘friends’. In the meanwhile, they will access price-comparison apps to get the best deal on that Tee and then buy it, if at all. Just yesterday, I was reading a FITCH report on ‘Gen Z and their purchasing habits’ and I discovered that FITCH calls this behavior the ‘Aspirational Browse’. I thought to myself, “Wow! I seem to be observing trends that FITCH thought worthy of coining a jargon around” 🙂 🙂 🙂 . This feeling buoyed me to pen down my observations.

Another observation about this generation is that they have a clear philosophy, “If I can use it without owning it, I will exercise that option”. This option frees up a lot of their money to be spent on other pursuits they find more ‘meaningful’. The pursuits could be, exploring not-so-famous destinations, pursuing a hobby in their spare time etc. or just being with friends. Earlier (say three to four years back), invariably the first milestone that my students (after passing out) would share with me was a purchase of a new car. They would tag me on facebook with a picture showing them standing next to or seated in a bright-coloured four-wheeler. That has changed over the last couple of years. Nowadays, from the younger alums, I get a ping with their pictures at the edge of a cliff somewhere in New Zealand or Uttaranchal or the like. This means, their money is being spent differently, of late. They are no longer saving to buy assets, they are spending on experiences which they perceive as more ‘meaningful’ and ‘fulfilling’. For them, a car is a means of locomotion and it is just a few clicks away on their mobile phone (read UBER/OLA). The thought process is, “If I can use it without owning it, why buy it”.

This mindset is something that is going to shape the future of all buying decisions henceforth, and mind you, not just for Gen Z.

This generation does not believe in buying assets, it has embraced the sharing economy.

That translates into questions like:

- Why buy a car when I can hire an UBER?

- Why buy a house, when I can rent one? Anyways, who knows in which corner of the world will I be tomorrow?

Implications on Businesses

- On producers of products and assets:

- What would be the implications on the automobile companies? They should alter their assembly lines to manufacture more low-end variants to satisfy the cab market as compared to high-end variants meant for personal usage.

- How should real estate developers look at their businesses? In many cities, you encounter the situation where the monthly rentals are substantially lower than the EMI the property owner pays. The younger generation understands this and prefers to rent, rather own it.

- On financing companies such as Banks & NBFCs:

- Their existing lending schemes are geared towards financing purchase of assets. That business will soon die out. They will have collaborate with producers of the products/assets and work out mutually-beneficial leasing models. They will have to share the marketing costs of these producers, by becoming a channel partner, if they have to survive in the Sharing Economy

Do share your thoughts on _________