Normally a disclaimer comes at the end of an article. Here, I will do so right at the beginning, in order that the reader gives my article a thought without any political biases.

Disclaimer: I am politically agnostic. I will not quote anyone, because I believe most people twist the interpretation of macro-economic data to suit their political inclinations.

I will keep this as objective as possible and leave it for the reader to come to a conclusion

First the sad story emerging from facts:

- GDP growth is down to 5.7%

- 99% of the demonetized notes came back into the banks, hence demonetization was a failed exercise. Should the country have suffered so much for no gain at all?

- GST has disrupted trade

- The rhetoric: What was the need to disrupt the fastest growing economy in the world with so many structural reforms?

The reality check

- GDP growth is down to 5.7%

This was expected due to liquidity being withdrawn from the economy post-demonetization. Everybody had said so, back in December ’16. So what’s the surprise?

- 99% of the demonetized notes came back into the banks, hence demonetization was a failed exercise. Should the country have suffered so much for no gain at all?

On the surface, this sounds true. The black money amounting to three to four lac crores of rupees that was not supposed to come back into the banks came back. This money has however, left a digital trail in the banking system.

- Close to 18 lac bank accounts (through which this tainted money has creeped into the banking system) have been blackmarked for further investigations.

- 37000 shell companies used for shielding and rerouting tainted money have been identified.

The concerned have already begun to get notices asking for explanations. Though sophisticated data mining technology is being used to nail the culprits, these investigations will take time and there is a possibility of corruption by investigating tax officials. How does the government plan to take care of this? That’s a question that experts need to discuss rather than shout those jingoistic rants on social media and television. I have read reports mentioning that the PM has asked the IT department to work out methods of encryption that will withhold the identity of the tax assesse from the tax inspector. If this becomes a reality, then this corruption will reduce substantially.

Another point I would like to raise here is

When will some of our CA and lawyer friends stop shielding tainted money by finding loopholes in the regulations and helping their shady clients hide behind the veil of justice?

On a positive note,

- Direct tax collections in the fiscal 2016-17 increased by 18%. (source: TOI, April 4, 2017).

- Direct tax collections in the Apr-July, 2017 are up by 19% as compared to the same period last year.

This means the tax base has widened. People probably prefer to pay taxes and make their money legal than being under the constant fear of being found out.

- Net inflows into mutual funds went up by a whopping 155.66% in the fiscal ending in March 2017 (source: LiveMint, April 11, 2017). People did move their tainted money away from shady transactions in real estate and parking it in gold to transparent investments in mutual investments

I think demonetization has its fair share of positives, the benefits of which will play out in the long run

- GST has disrupted trade

This once again is true, but it also convinces me that most of the businesses in our country baulk at the thought of transparency and governance. No doubt there are operational issues in the implementation of the GSTN (GST Network). However, in a country as complex as ours, nothing can be expected to be rolled out smoothly the first time. All countries that have rolled out a uniform tax rate have suffered compromised GDP growth for a couple of years. Should the fear of disruption stop us from adopting GST?

All experts (across political inclinations) say GST is the right thing, but keep on ranting about the implementation without suggesting any options. Why don’t experts (cutting across their political affiliations) come together and iron out the glitches in a ground-breaking structural reform?

- What was the need to disrupt the fastest growing economy in the world with so many structural reforms?

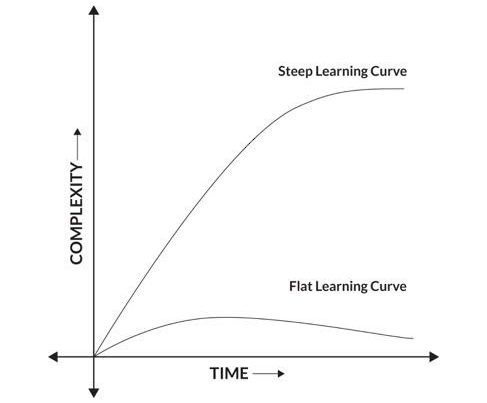

The economy was growing at a good clip, agreed. However, my limited understanding of management tells me that a company which experiments and spends on R&D when the going is good is the one that stands out in the long run, as compared to others that wait for bad times to come. Invariably in bad times, there are no resources left for trying anything new and the status quo continues. Innovation happens when companies cannibalize their own successful creations, whereas, companies that keep gloating over their past successes are the ones that fade into oblivion. The same logic applies in macro-economics too. Should a government wait for the economy to be comatose, in order to infuse structural reforms or should it do so when the going is good?

In my view, structural reforms should be introduced when the economy has the buffer to absorb the shocks. The following statistics clearly demonstrate why:

- Fiscal deficit had declined from 4.5% in 2013-14 to 3.5% in 2016-17 (largely due to depressed international oil prices). What the hell, one needs to capitalize on one’s luck

- CPI inflation remained under control for the third successive year (2.36%) from 2013-14, well under the government’s target of 4%

- India’s trade deficit fell from $190.3 billion in 2012-13 to $118.7 billion in 2015-16, despite sluggish exports due to a global slowdown.

- Foreign Direct Investment in Dec 2016 was up by 14.2% as compared to Dec 2015.

(Source: All the above statistics from India Today, September 18, 2017, “The Big Slide”

You decide whether demonetization and GST should have been launched when they were, or we should have waited for the economy to be in a downward spiral.

Some Sidelights to ponder upon:

- RERA (Real Estate Regulation Act) has slowed down that sector, but is the consumer’s interest not going to be better protected in the long run?

- Bankruptcy code action is being pushed hard by the government. Banks should get the whip cracking and solve problems that should have been solved long ago. Promoters are in a bind now and hence further investments are slowing down stagnating job growth. But should NPAs be allowed to rise in pursuit of a cancerous growth?

Once again, I urge you to decide.