Digitization as a boost for consumption in the Indian economy- If only, Indian business houses looked at digitization (subsequent to demonetization), as a positive disruption & relooked at their business models, it would boost consumption.

Internet of things and Telematics: Converting product businesses into hybrid (product cum service) businesses

With internet connectivity becoming ubiquitous, every object will soon become electronically connected with everything around, i.e. every object will become identifiable by a unique IP address, e.g. your mobile phone can tell you the temperature your refrigerator is operating at OR you can control your microwave or your doorbell through your mobile phone…..the possibilities are endless. The phone is just an example that I have cited, the device could well be your laptop, your watch or your tab or anything else that is internet-enabled.

Some more examples:

- With the IOT, you would get to know how much fuel is available in your car’s fuel tank, sitting at home, on any internet-enabled device.

- You would also get an alert from your car tyre manufacturer that the tyres of your car need a retread or a replacement. How? The tyres would have embedded sensors which would be connected to the cloud and would constantly feed information about the condition of your tyres, to the tyre manufacturer.

So, basically every object that we use will be connected to the worldwide web and all performance data will be traceable and available for appropriate action by the manufacturer.

How would this happen? It’s quite simple. Every object will be embedded with sensors that are internet enabled and can transmit data to each other and to the internet cloud, where it can all be captured, diced & sliced for interpretation and appropriate action.

How would IOT impact Business?

All business models would gradually shift to some variations of the ‘Pay per Use’ model.

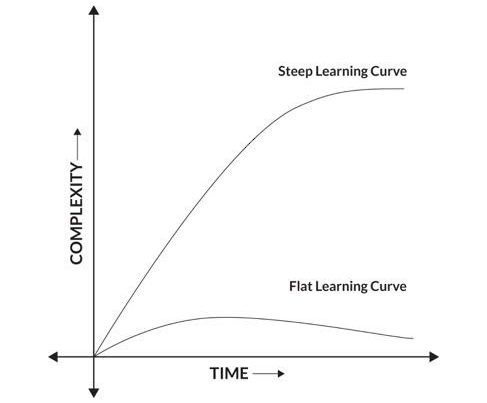

How? Companies would soon begin selling products that will be embedded with internet-enabled sensors and hence capable of transmitting performance data back to the company. Companies have already begun to use this data to send alerts to consumers about maintenance of such products (i.e. XYZ component needs servicing, ABC component needs replacement etc.)

What does the future hold? Since companies would also know the extent to which and under what conditions (tough or normal), the product is being used, they would begin to charge consumers on the basis of how much and at what level of wear and tear, the product is being used. E.g. if I am driving my car, the manufacturer would know how many kilometers on what kind of terrain I am driving. If I am driving on an expressway, I would be charged, say, Rs. 8 per kilometer. If I am driving on a rough country road, I would be charged, say, Rs. 10 per kilometer. The latter being higher because I would be subjecting the car to a greater wear and tear. With such data available, the manufacturer would be able to sell me a car at a small down payment, which is a fraction of the entire selling price that I have to shell out today and a recurring cost to be paid to the manufacturer as and how I use the car in future. This would fuel demand in a world that is wilting under recessionary winds. Indian business houses should make the maximum of the ecosystem that the Indian government is trying to create with its relentless pursuit towards a digital economy.

How would the payment loop be completed?

We already have payment mechanisms like the payment wallets gaining popularity post demonetization. In India, we have the Unified Payment Interface (UPI) that the government needs to publicize more. The usage charges would be debited either via the UPI interface or from your e-wallet, as and when and how you use the product.

Implications

- The consumer gets to own a product at a fraction of the cost, plus she/he gets a much higher level of service through regular maintenance alerts etc.

- The seller gets more consumers hooked onto their products for a longer period of time (almost a lifetime with a series of products), paying recurring installments spread over the lifetime of the product. After all, marketing intellectuals, these days, talk eloquently about Customer Lifetime Value (CLV).

Hence, it would be a win-win situation for both, the consumer and the seller. The impact on economies globally, would be downright positive.

This model should be quickly adopted by manufacturers and sellers of consumer durables (they are the ones complaining about sluggish offtake for the last few years). As is, it may not apply to the low value FMCG category